So, you have decided to leverage the power of AI for your trading. That’s a champion move, considering there are AI tools for stock trading that can analyze monumental market data in seconds. They can give you the exact insight you need for your trading strategy. In fact, many can now even frame a custom strategy for you based on your preferences. Using AI for stock trading, then, only becomes the natural progression in your trading practice.

Having said that, there is a strong advisory due here, and let me lead with a proof. A 2021 report by engineers from Florida International University concluded a “median performance” of using AI & ML in the stock market. So, no matter what AI tool you plan to use and how, there is one mutual guarantee: that there is no guarantee. Meaning – you would quickly turn from the smartest trader to the most idiotic one, if you solely rely on an AI tool for your trading.

With that clear, it is time to dive into the best AI tools you can use today to improve your trading game and how.

Table of contents

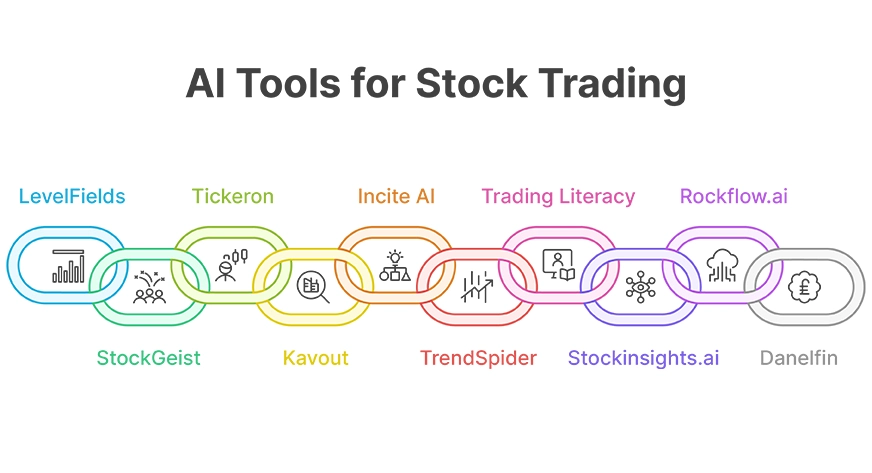

Top 10 AI Tools for Stock Trading

We have listed the top 10 AI tools meant to help with your stock trading here. Though these are in no order of authority, as each offers a different set of functionalities, and there is no inherent comparison to be made. So, have a look, and feel free to pick and choose among these as per your trading needs.

1. LevelFields

As its name suggests, this AI tool aims to “level the playing field for investors” by outing the “pro” strategy that only a handful of expert investors are aware of. Technically, LevelFields is a research automation platform for self-directed investors, which claims to find better investments for its users “1800X Faster.”

Now we are not sure how it came to that number, but the AI trading tool is among the most talked-about tools of its kind. Its AI scans for events proven to impact stock prices. As per the information on its website, the AI screens over 6,000 stocks for millions of signals. Its goal is to find said events using historical data for patterns. It then puts the events into context for traders to better judge the right entry and exit points in a trade.

Pricing: LevelFields is a paid tool with a pretty decent monthly fee attached to it. For $25 per month (when billed annually), it grants you almost complete access, except for its premium alerts. Those wanting the premium alerts, a newsletter, and an hour-long training session may opt for the $1599 per year plan.

2. StockGeist

While LevelFields helps identify patterns for the right entry and exit, StockGeist works as a market sentiment monitoring platform. The AI here is responsible for monitoring the ongoing popularity of 2200+ publicly traded companies. How does it do that? It gathers and analyzes textual information from social media live, to identify the current public sentiment around any particular stock.

Now, any seasoned trader would know how positive and negative sentiments around a stock can drive price fluctuations. With market sentiment being one of the most reliable indicators in trading, you may want to include StockGeist in your AI trading toolkit

Pricing: Interestingly, Stockgeist offers a free tier for investors to try their hand at it. There are then options to upgrade to a $50 and a $100 plan, based on the number of days of sentiment data needed.

3. Tickeron

Consider this one as a collection of AI tools, each meant for a specific task. To give you a couple of examples, Tickeron has an AI Signal Agents that provide real-time trading signals, an AI Pattern Search Engine that finds end-of-day patterns, breakouts, target prices, and confidence levels, and many more such pretty handy AI-driven tools.

Some other Tickeron tools worth mentioning here include an AI Trend Prediction Engine, AI Stock Screener, and AI Real Time Patterns. Collectively, these tools are quite capable of elevating anyone’s trading strategies by providing strategies, insights, and any other data points you may require.

Pricing: Tickeron provides a free trial for 13 days and charges $30 per month afterwards. So you can easily try it out before making any commitments. Just make sure to use all/ as many of its offerings as you’d like to build a well-rounded trading strategy

4. Kavout

Kavout is a suite of AI investing tools that work across stocks, ETFs, and cryptocurrencies. Some of the popular offerings on the platform include AI Stock Picker, InvestGPT, Signal DB, and more. Collectively, these can help you get real-time analysis, discover insights, and even get instant answers for your queries, powered by a ChatGPT API.

Kavout works by connecting isolated data silos and turning simple data connections into complex networks. This helps spot deeper patterns and intricate relationships, uncovering new investment opportunities that would be missed otherwise. Couple this power of AI with the traditional trading features like Market Movers and Superinvestor Holdings, and you have an extremely powerful trading platform at your behest.

Pricing: Kavout offers its features in 2 tiers – Free and Pro. While the former allows limited searches, prompts, and features, the Pro version gives an all-out access to the platform for a monthly fee of $20.

5. Incite AI

The folks at Incite AI call it a “Live Intelligence,” instead of a typical AI, solely based on the fact that it is built on real-time data. At present, it focuses on global financial markets for insights, with future plans of expanding into sports. The company says that the AI tool is “designed for decisions,” and does so by assembling and reviewing up to thousands of relevant data points in seconds.

Current capabilities of Incite AI range from live decisions and strategy to projecting and forecasting, simulating probable outcomes, advanced inference and reasoning, and live research. In the future, the company also promises to bring support for more financial assets, including crypto, ETFs, mutual funds, and more.

Pricing: Incite AI is completely free to use at present but may include a pricing structure in the future, once it brings on more features onboard.

6. TrendSpider

Another, and a rather famous, all-in-one trading platform, TrendSpider is a complete package for all (or most) of your trading needs. It prides itself on its “Industry-leading artificial intelligence, machine learning & automation capabilities,” which has managed to garner a flood of positive reviews for the platform from across the trading community.

Some of the powerful features offered here let you simply converse with TrendSpider to understand market conditions, use AI to write custom studies, indicators, and identify patterns. It even lets you train your own machine learning models for custom trading strategies that can help you identify entry and exit signals.

Pricing: TrendSpider comes with three pricing plans, costing $19, $29, and $39 per month for Standard, Premium, and Enhanced, respectively. All of these come with a free 14-day trial, so you might want to check it out before buying a plan.

7. Trading Literacy

Basically, a custom GPT model, Trading Literacy brings a chat-based format for trading and market insights. Just like ChatGPT, it lets you converse with the AI model to get more insights from your investment activity. As the platform itself highlights, “you can ask questions, get reports and summaries, find risk-adjusted values and more,” through simple prompts. Basically, a simple chat to get all your stock trading-related information.

Pricing: Trading Literacy is available with 2 paid plans – Investor and VIP. The first one costs $19 a month and allows limited document upload. The latter costs $119 per month (unlimited document upload) and is meant for those managing a set of portfolios.

8. Stockinsights.ai

Currently restricted to the Indian and US stock markets, this AI tool helps with extensive financial research, leveraging the power of generative AI. Comparatively new on the list, Stockinsights.ai uses AI to analyze public company filings, earnings reports, call transcripts, investor presentations, and other disclosed information about a company.

It then uses the data for actionable trading points like sentiment analysis, numerical extraction, entity tagging, auto classification, and more. The platform even provides its API so you can integrate it into your own workflow for smoother output.

Pricing: Stockinginsights.ai offers just 1 price plan other than the free section, which has limited access to its features. The paid version costs $200 a year. There is also an option of custom pricing for advanced users who would like customizations.

9. Rockflow.ai

This New Zealand-based startup has lately been making waves in the fintech industry, primarily for repackaging stock trading in a Gen-Z-friendly way. It is in this pursuit that the company has come up with many beginner-friendly terms. Some famous ones include “baby bull,” “baby bear,” and “dip sniper.” The whole idea is to make trading as simple as possible, for new entrants to trade without having to understand complex terminologies and processes.

For the processes part, the platform uses the power of AI, promising an AI-first trading experience. Its integrated TradeGPT (ChatGPT model), powered by RockFlow’s investment research and Quantification Algorithms, provides daily trading opportunities based on AI models. What’s more? It allows investors who are just starting out to begin with a tiny initial investment of just $1.

Pricing: Not just a straight-up AI stock trading tool, Rockflow is a complete trading platform. It, hence, charges a fee on transactions, deposits, and withdrawals. Pro: There is no subscription cost. You only pay if you actively indulge in trading. Con: Since there is no fixed cost, there is no upper cap either.

10. Danelfin

A stock analytics platform powered by AI, Danelfin helps investors pick the best stocks for data-driven investments. It analyzes all US stocks and STOXX Europe 600 stocks, and US-listed ETFs by transforming complex indicators and features to rate stocks and ETFs with an easy-to-understand score.

This score is called a global AI Score. With the score ranging from 1 to 10, a high score (7 to 10) means that the stock has a high chance of beating the market in the next 3 months. Stocks and ETFs with the lowest AI Scores (1 to 3) have a lower probability of beating the market.

Pricing: Danelfin offers three tiers, with one of them being free. The other 2 are priced at $19 and $52 per month. Both paid plans also have a 14-day free trial.

Also Read: Build a Model to Predict Stock Prices using ChatGPT

Stock Trading with AI Tools – Pros and Cons

With the current technology of AI, it is too soon to claim AI can beat the stock markets. So, before you start using any of the tools on the list, here are some pros and cons of AI-based stock trading that you should know of.

Pros

- The biggest plus here is that AI tools let you crunch millions of numbers within fractions of a second. Decision-making within stock trading thus gains peak speed and efficiency for most users. And as all traders know better than the masses, time is money!

- There is no emotional bias with AI-powered trading. AI tools can easily skip past all the human emotions to provide an educated trading strategy guided solely by data.

- AIs are also much more efficient in identifying trends and breakout patterns in the market. To add to that, they can automate your trading based on this analysis by working 24×7.

- For traders working on systems, several AI tools offer backtesting of strategies on historical data. So before you go live, you know exactly how your strategy has worked in the past.

Cons

- AI tools built for stock trading are notoriously famous for their false confidence in signals. Especially so with unpredictable events or low-volume stocks.

- AI can make predictions using existing data, not the real-world sentiment. So, over-reliance on backtesting is also not suggested when using AI tools for trading. What worked in the past may not be relevant in the time to come.

- As you start experimenting with AI trading tools to find your ideal fit, you will realize that most of these are quite expensive, especially for more advanced strategies, insights, and use cases.

As a general rule, make sure never to over-rely on AI for trading. Only use these for processes you, yourself, have a thorough understanding of. Combine these with your own expertise and insights, and they are sure to be your best possible bet on cracking the stock markets.

Conclusion

With a mix of such AI tools in your arsenal, your trading game will get a lot more efficient. These tools can crunch years and decades of numbers within seconds for actionable insights on any commodity. This means you will have just the information you need, in the form you need it, right when you need it to make that one big decision.

With that in consideration, never forget the classic investor’s warning – stocks are subject to market risks. So, even with these AI tools to help you, do not cross the thin line between confidence and overconfidence. Always be careful of the insights you get (and use) from such tools.